In the ever-evolving landscape of fintech, a new wave of companies has emerged to disrupt traditional banking and financial systems. One such pioneer is Wise, a London-based fintech company that has revolutionized how people transfer money internationally. Formerly known as TransferWise, the company rebranded as Wise in 2021 to better reflect its expanded range of services beyond money transfers. Since its inception in 2011, Wise has garnered immense popularity, boasting over 10 million customers worldwide and saving them billions in hidden fees.

The Birth of a Game-Changer

Founded by Taavet Hinrikus, the first employee at Skype, and Kristo Käärmann, a former management consultant, Wise was born out of their frustrations with the excessive fees associated with international money transfers. Hinrikus and Käärmann were experiencing the challenges of working in different countries while getting paid in foreign currencies. They realized that, by using a peer-to-peer system, they could bypass the traditional banking intermediaries and transfer money at the mid-market exchange rate, which is the fairest rate available. This was the inception of Wise.

The Mechanics of Wise

At its core, Wise operates on a peer-to-peer model, which sets it apart from conventional banks. When a user wants to transfer money to another currency, Wise matches them with someone who wants to share capital in the opposite direction. For instance, if you want to exchange US dollars for euros, Wise will find someone who wants to exchange euros for US dollars. By doing so, Wise can avoid the need for actual currency exchange and bypass the corresponding fees.

Furthermore, Wise is remarkably transparent. Before initiating a transaction, customers are shown the exact amount of money that will be received and the fees to ensure complete clarity. There are no hidden charges or markups on exchange rates. The company has always prided itself on making the process as straightforward and cost-efficient as possible for its users.

Lower Fees and Competitive Rates

Wise has been a game-changer for individuals and businesses making international money transfers. Traditional banks often impose overt and hidden hefty fees on cross-border transactions. These fees can erode a significant portion of the money sent, leaving customers dissatisfied and financially burdened.

With Wise, customers typically pay a small, transparent fee for the service, which is often significantly lower than what banks charge. Moreover, by using the mid-market exchange rate (the rate you see on Google), Wise ensures that customers get a fair deal and aren’t subject to the unfavorable exchange rates often applied by banks.

Expanding Services Beyond Money Transfers

Launched initially as a money transfer service, Wise has since expanded its offerings to provide its customers with a broader range of financial services. As a result of this growth and to reflect its enhanced mission, the company rebranded to Wise in 2021. Today, Wise offers services such as:

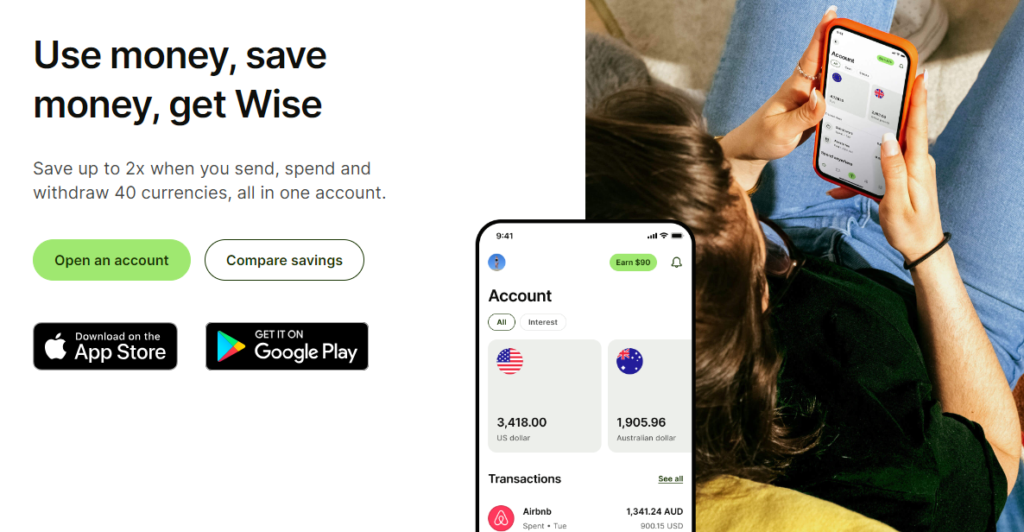

- Wise Borderless Account: This multi-currency account enables users to hold and manage money in multiple currencies. With local bank details in various countries, customers can receive payments like a local, saving them money on international transaction fees.

- Wise Debit Card: Wise introduced its debit card to give users easy access to Borderless Account funds. It allows customers to spend in any currency at the real exchange rate, eliminating typical bank foreign transaction fees.

- Wise Business: Catering to businesses of all sizes, Wise Business provides tools and services to manage international finances efficiently, including payroll, accounting integration, and expense management.

- Wise API: Wise offers an API that allows other businesses to integrate Wise’s services directly into their platforms, making cross-border payments seamless for their customers.

Regulation and Security

Wise is a fully regulated financial institution adhering to strict security and compliance standards. It is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom and licensed as a money transmitter by regulatory authorities in various countries where it operates. Customer funds are held in segregated accounts, providing an additional layer of security.

Join the Wise Revolution Today!

Now is the perfect time to experience the future of international money transfers with Wise. Sign up today using our referral link, and you’ll receive a free fee transfer of up to 500 GBP (or the equivalent in your currency). By joining Wise through this exclusive offer, you can send money overseas without worrying about excessive fees and hidden charges. Take advantage of Wise’s peer-to-peer model, transparent pricing, and fair exchange rates to make your money go further.

Take advantage of this incredible opportunity to be part of the fintech revolution and embrace a more transparent and customer-centric financial experience. Seize the moment, and together, let’s build a world where fairness, transparency, and empowerment shape how we transfer money internationally. Join Wise today and take the first step toward a brighter, fairer, and more cost-effective financial journey!